What Are The Fees on Bloom Bot

Bloom Bot, a Solana-oriented trading bot introduced in the year 2024, has become popular for its speed, user interface quality, and a multitude of cruising features for trading of meme coins.

Knowing your fee schedule is a must-have for traders looking to maximize profits in the roller coaster known as the Solana ecosystem.

This article explains Bloom Bot’s fees, such as:

As well, how they affect the trades and how to minimize the fees, comparing it to alternatives such as Nova Click.

Summary of Bloom Bot Fees

Bloom Bot charges both platform and network fees for fast, secure trades on Solana as well as supported blockchains like Base, Ethereum, and BSC.

These charges allow for the priority order of transactions, platform support, as well as shielding the trader from market risks. Here are the salient fee elements:

Platform Fee

- A fee assessed on a percentage of the amount to be bought or sold.

Urgent Fee

- An optional fee for transactions to be confirmed.

Bribe Fee

- A reward for validators to process a transaction more quickly.

MEV Protection Fee

- A fee to counter front-running attacks.

Token Account Creation Fee

- A one-time Solana network fee for new Tokens.

These charges trade off speed, safety, and cost, but have different implications on trade size and market environment.

Traders need to carefully adjust fees to make a profit. Medium strength games can help to try to recover some of the errant settings; very low strength is a great way to lose all your money if that is what you like.

The settings are way off!

Like seriously, you will lose money using them, and there will be less money to be had on small trades.

How to Use Bloom Bot - Full Tutorial

Complete Bloom Bot Pricing Breakdown

Every fee type in Bloom Bot is fundamental to Bloom Bot’s trading system.

The following fees provide a detailed overview of official documents and experience from users.

All of the fees are paid in SOL, that is, Solana’s native coin.

Platform Fee

It charges a 1% platform fee on each buy and sell, with that dropping to 0.9% when users sign up via a referral link.

This is based on the token amount for the trade; it's used for platform development, server maintenance, and to implement new features. To wit, on a 2 SOL buy, you end up paying 0.02 SOL in fee (0.018 SOL with referral), which brings the price down to 1.98 SOL.

Avoiding Bloom Bot Fees

There are a few things you can do to prevent Bloom Bot fees.

Doing so, you will maximize fees, which increases profit while not impacting the speed or security of Bloom. These tactics, "crowd-sourced" by traders, save money. Adjust the dynamic parameters so that they can meet the market trend.

Utilize Referral Links

Register through a referral code to bring the platform fee down to 0.9%.

Trade Larger Amounts

Increase trade size to >0.5 SOL to reduce the percentage impact of fixed fees, such as priority and token account creations.

Priority Fees

Customize your priority fees and turn them into 0.001 SOL for normal trade and 0.03 SOL according to Pro Traders.

Low Cost of Bribes

Use 0.002–0.005 SOL bribes in under-served markets and as low as 0.015 SOL for high-competition launches.

Turn off MEV Protection on Low Risk

You can use MEV protection, but when making low-risk trades or sells you can shut off MEV to remove bribe fees, but keep monitoring for sandwich attacks.

Avoid Pump.fun Tokens

Trade moved tokens on Raydium or Jupiter to avoid the 1% protocol fee.

Close Token Accounts

Only use if you wish to recover ~0.0023 SOL per closed token account sold.

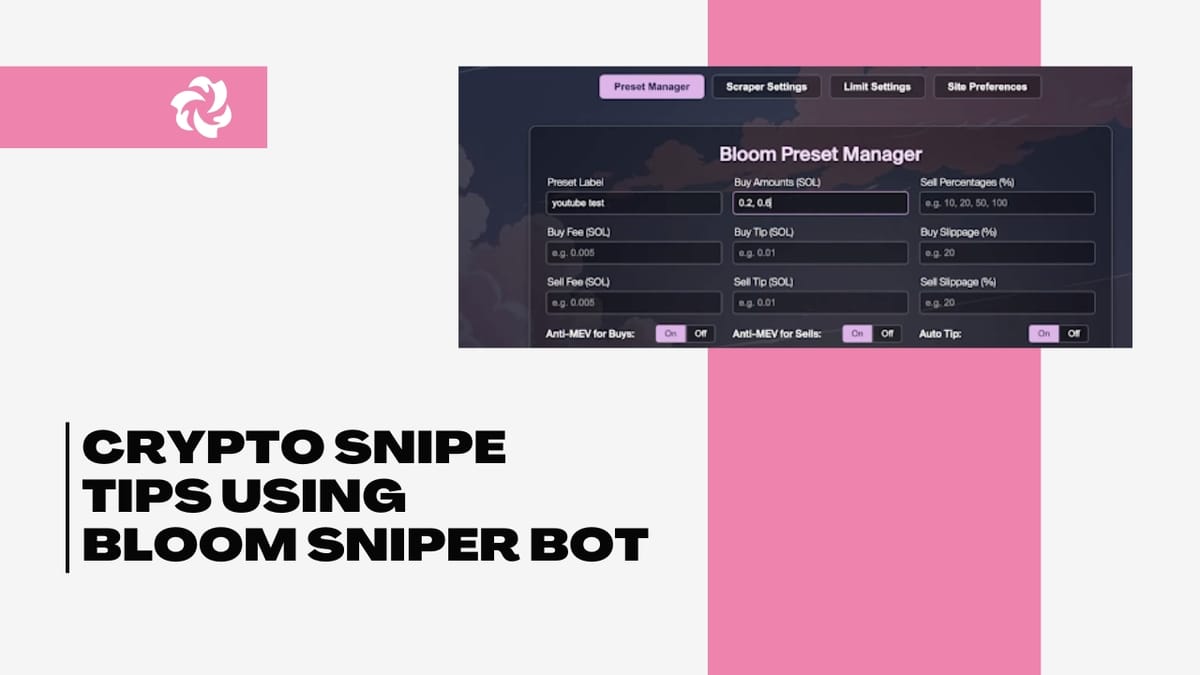

Use Presets

Set presets for fees on /settings (e.g., 0.001 SOL → for buying, 0.03 SOL → for sniping) to make low-fee trades automatically.

These tricks can save you 20–40% in fees, especially for active traders. Check settings frequently through Bloom’s Telegram interface to keep your costs at a minimum. Commentary on Reddit from the community reflects the preference for discounts for referrals and pre-set adjustments.

Comparison with Nova Click and Others

Bloom Bot’s fees are competitive, but they are not the bottom of the barrel. This comparison among trading bots on Solana provides the most perspective on how good it is.

Bloom Bot vs. Nova Click

Another top bot, Nova Click, charges a 1 percent platform fee (0.9 percent with referrals), identical to Bloom’s pricing.

Both advise similar priority (0.001–0.03 SOL) and bribe fees (0.002–0.015 SOL). The Nova Click Chrome extension and Twitter-trigger integration are nice, but Bloom’s sniping presets and AFK mode have just as much muscle.

- Fees: Same platform fees (0.9% with referral); Preset flexibility from Bloom is equivalent to Nova Click’s quick buy buttons.

- Pros: Slightly better value than Nova Click on Solana, but not quite as superior on the multi-chain front (Ethereum, Base).

Bloom is just as snappy as Nova is when it comes to sniping, but Bloom’s fee presets are easier to play with if you make a lot of small trades. — Reddit user, r/Solana, 2025.

Bloom Bot vs. BullX Neo

BullX Neo has a 1% platform fee (0.9% with a referral) — the same as Bloom.

Its priority fees and bribe fees (0.01–0.015 SOL default) are close to Bloom’s, but BullX Neo’s web-Telegram hybrid interface provides additional analytics. Bloom is Telegram-only, emphasizing simplicity.

- Fees: Same platform fee; BullX Neo’s static 0.002 SOL bribe in MEV mode may raise costs.

- Pros: Bloom’s Telegram ease and AFK sniping > BullX Neo (plays slower, I have a 20–30 sec lag).

Bloom Bot vs. Sniperoo

Sniperoo has a lower 0.845% platform fee (Bloom’s is 0.9%). Its priority and bribe fees are similar (0.001–0.03 SOL), but Sniperoo has revert protection to prevent you from incurring fees on unsuccessful transactions – a feature Bloom does not have.

- Fees: Sniperoo’s 0.845% fee is lower; Bloom’s 1% fee is average but less competitive.

- Pros: Bloom has more advanced sniping and copy-trading tools than Sniperoo’s simple interface.

How to Copy Trade with Bloom Bot

Real-World Fee Examples

To demonstrate the impact of fees, let’s compare fees on three trades of varying sizes and circumstances:

Small Trade (0.2 SOL)

1% platform (0.002 SOL) + 0.01 SOL priority + 0.01 SOL bribe + 0.002 SOL Pump.fun + 0.002 SOL Pump.fun sell + 0.0023 SOL token account = 0.0283 SOL amount collected in total. That 0.1 SOL would give you ~0.0717 SOL after a 50% gain, and you'd be just barely in the black.

Medium Trade (1 SOL)

0.9% platform (0.009 SOL, with referral) + 0.005 SOL priority + 0.005 SOL bribe + 0.0023 SOL token account = 0.0213 SOL total. A 20% gain (0.2 SOL) nets the seller ~0.1787 SOL, profitable with a nice cushion.

Big Trade (5 SOL)

0.9% platform (0.045 SOL) + 0.015 SOL priority + 0.015 SOL bribe = 0.075 SOL total. 10% gain (0.5 SOL) deposits ~0.425 SOL, very nice.

This makes larger trades more efficient because fixed costs such as the token account creation can be considered orders of magnitude cheaper.

Small trades need to generate outsized returns just to cover fees. Bloom’s openness makes it easy to plan trades.

How to Snipe 100X Meme Coins Using Bloom Bot

Is Bloom Bot Worth the Fees It Collects?

The fees are justified for active and high-volume traders, but less ideal for casual users.

The 0.9–1% platform fee, together with optional priority and bribe fees, enables fast execution and MEV protection, and is necessary for Solana’s meme coin market.

Here’s how the fee schedule will work for different types of traders:

Casual Traders (Small Trades, 2 SOL)

2–5% of trade value, hence needing 5–10% returns. Bloom’s velocity, MEV shield, and cross-chain support are a big delta. Set SOL fees at 0.015–0.03 for launches.

Bloom’s rates are standard for the industry (gauged primarily in the speed, security, and automation provided).

High-return tokens or big trades are the targets of those traders who benefit most. Recreationalists should spend it or check out something more affordable.

Conclusion

Bloom Bot’s transparent fee structure - 1% (0.9% with referral) platform fee, 0.001–0.03 SOL priority/bribe fees, MEV protection, and 0.0023 SOL token account creation that helps power the platform’s rapid and secure trading environment.

Small trades suffer from high relative costs, but medium to large traders enjoy the sniping, automation, and anti-MEV that Bloom provides.

Check out our latest guides on BloomBot: