Solana vs Ethereum: A Comparison for DeFi Traders

Thinking about which blockchain to focus on for your decentralized finance (DeFi) trading? You've probably heard a lot about Solana and Ethereum. They're both big players, but they work pretty differently, especially when you're trying to make quick trades. This article breaks down the core differences, focusing on how tools like Bloom Bot can help you trade on Solana. We'll look at what makes Solana tick for traders and how you can get started with a popular trading assistant.

Key Takeaways

- Solana offers much faster transaction speeds and lower costs compared to Ethereum, which is a big deal for active traders.

- Bloom Bot is a Telegram-based trading tool that makes it easier to trade on the Solana network.

- You can use Bloom Bot for various trading actions, like finding new tokens early (sniping), making quick buys and sells, and automating trades with AFK mode.

- For more control, Bloom Bot lets you set limit orders, copy successful traders, and use Degen Mode for high-risk trades.

- Trading on Bloom Bot typically has a 1% fee per transaction, but using a referral link can lower this to 0.9%, making it quite affordable.

Understanding Solana Vs Ethereum For Trading

When you're looking to trade crypto, you've probably heard a lot about Solana and Ethereum. They're both big players, but they work pretty differently, especially when it comes to trading. Understanding these differences is key, and it's where tools like Bloom Bot come into play, making the Solana side of things much more accessible.

Key Differences in Blockchain Architecture

Think of blockchains like different highways for digital money. Ethereum's highway is older, more established, but also tends to get congested. This congestion means transactions can be slow and, more importantly for traders, expensive. Solana, on the other hand, was built with speed and low costs in mind from the start. Its architecture is designed to handle a much higher volume of transactions, making it feel more like a modern, multi-lane superhighway. This difference is why many new projects and traders are looking at Solana for faster, cheaper trades, especially when using a bot like Bloom Bot which is built specifically for this environment.

Transaction Speeds and Costs

This is where Solana really shines compared to Ethereum. Solana can process thousands of transactions per second (TPS), while Ethereum's capacity is much lower, though it's improving. For you as a trader, this means Solana transactions are usually confirmed in seconds, and the fees are often just a fraction of a cent. On Ethereum, you might wait minutes for a transaction and pay several dollars in fees, especially during busy periods. For active traders, these cost and speed differences are massive. Imagine trying to quickly buy a new token that's just launched; on Solana, you can likely get your order in instantly with minimal cost, whereas on Ethereum, you might miss the opportunity or pay a lot just to get your transaction processed. Bloom Bot is designed to take advantage of this speed on Solana, helping you execute trades faster.

Smart Contract Capabilities

Both blockchains use smart contracts, which are basically self-executing agreements. Ethereum pioneered this, and it has a very mature ecosystem for smart contracts, meaning lots of developers have built on it for years. Solana also has smart contracts, but it uses a different approach that allows for higher performance. This means that while Ethereum has a vast array of complex applications, Solana is catching up quickly, especially in areas where speed and cost are important, like decentralized finance (DeFi) trading. For example, using a trading bot like Bloom Bot to snipe new tokens or automate trades relies heavily on efficient smart contract execution, something Solana is well-suited for. You can explore different trading bots for Solana and Telegram to see how they utilize these capabilities here.

The choice between Solana and Ethereum often comes down to what you prioritize: the established, extensive network of Ethereum, or the speed and cost-efficiency of Solana. For active trading, especially with tools designed to capitalize on quick market movements, Solana's advantages are hard to ignore. You can see how Solana's efficiency compares to Ethereum in more detail here.

Solana's efficiency also extends to other areas, like NFTs, offering a faster and cheaper experience for minting and trading compared to Ethereum, as noted here. This overall performance makes it a strong contender for various applications, including the fast-paced world of DeFi trading where tools like Bloom Bot aim to provide an edge.

Bloom Bot: A Solana Trading Ecosystem

So, you're looking to get into trading on Solana, and you've heard about Bloom Bot. That's a good start. Think of Bloom Bot as your personal assistant for navigating the fast-paced world of Solana DeFi. It's built right into Telegram, which is pretty convenient, meaning you can manage your trades without leaving the app you probably already use all day. Whether you're trying to catch new tokens right when they launch or just want to automate some of your trades, Bloom Bot aims to make things easier.

Introduction to Bloom Bot Features

Bloom Bot packs a bunch of features designed to help you trade smarter. You can use it to "snipe" tokens, which means buying them the moment they become available, potentially getting in before the price really moves. There's also a quick buy and sell function for when you need to react fast to market changes. Plus, it has an "AFK Mode" that lets you set up trades to run automatically, even when you're not actively watching. It's like setting your trades on autopilot.

Setting Up Your Trading Wallet

Getting started with Bloom Bot is pretty straightforward. When you first connect, the bot will help you create a new Solana wallet. It's super important to write down your private key and store it somewhere incredibly safe. This key is the only way to access your wallet, and if you lose it, your funds are gone. Seriously, don't skip this step. You can access Bloom Bot from any device where you have Telegram installed, making it easy to trade on the go. You can find a list of other trusted dApps on the Solana blockchain to explore alongside Bloom Bot here.

Depositing Funds for Trading

Once your wallet is set up, you'll need to put some funds in it to start trading. The native currency on Solana is SOL, and you'll use that for both your trades and to pay transaction fees. To deposit, you just send SOL to the wallet address Bloom Bot gives you. Just be sure to double-check the address before you send anything. It's a good idea to start with a smaller amount until you get the hang of how everything works.

Bloom Bot is known for being quite affordable compared to other options out there. For instance, many bots charge higher fees, but Bloom Bot keeps things simple. You can even get a discount on fees if you sign up using a referral link, bringing the cost down. This makes it a solid choice if you're watching your expenses. Some bots, like Axiom Trade, also focus on professional strategies and have similar fee structures 0.75% to 1%.

Fees are a necessary part of running a platform like Bloom Bot. They help pay for keeping the servers running, developing new features, and making sure the bot stays secure. This means your fees go back into making the bot better for you over time.

Here’s a quick look at the fee structure:

- Standard Fee: 1% on all buy and sell transactions.

- Discounted Fee: 0.9% if you sign up using a referral link.

This transparent approach means you know exactly what you're paying for, and the referral discount is a nice bonus for users. It's a good way to keep costs down, especially if you trade frequently. You might also find other bots like Maestro Bot offer advanced tools for traders, but Bloom Bot's focus on ease of use and cost-effectiveness is a big draw. Learn more about AI trading bots and how they can potentially improve win rates, though always remember that past performance doesn't guarantee future results.

Core Trading Functionality on Bloom Bot

When you're ready to start trading, Bloom Bot gives you a few ways to jump into the action. It's designed to be straightforward, whether you're trying to catch a new token right at launch or just want to make a quick trade.

Sniping for Early Token Opportunities

One of the main draws of Bloom Bot is its ability to help you get in on new tokens early. This is often called 'sniping'. You can set up a task to buy a token the moment it becomes available. You'll need the token's contract address, and then you can set things like how much you want to buy and how much slippage you're willing to accept. Bloom Bot handles the rest, aiming to get your transaction processed as fast as possible. This can be a good way to get into promising projects before the wider market catches on. You can find new tokens across the Solana ecosystem using tools that integrate with bots like Bloom Bot.

Executing Quick Buy and Sell Orders

Sometimes, you don't need to set up a complex task. For those moments when the market is moving fast and you need to react quickly, Bloom Bot has a 'Quick Buy' and 'Quick Sell' option. You just input the token's contract address, the amount you want to trade, and confirm. The bot processes it right away. This is super handy for making fast trades without a lot of fuss, helping you keep up with sudden market shifts.

Leveraging AFK Mode for Automation

If you can't always be watching your screen, Bloom Bot's AFK (Away From Keyboard) Mode is pretty useful. It lets you set up rules for trading and then runs them automatically. You can define things like how much to buy, market cap targets, or even stop-loss levels. This means Bloom Bot can manage your trades based on your strategy even when you're offline. It's a way to automate your trading approach and not miss opportunities just because you're busy. This feature is part of what makes Bloom Bot a solid choice for managing your trades on the Solana network.

Advanced Trading Strategies with Bloom Bot

Ready to take your Solana trading to the next level? Bloom Bot offers some pretty cool advanced features that can really change how you approach the market. It's not just about quick buys and sells anymore; you can get more strategic with your trades.

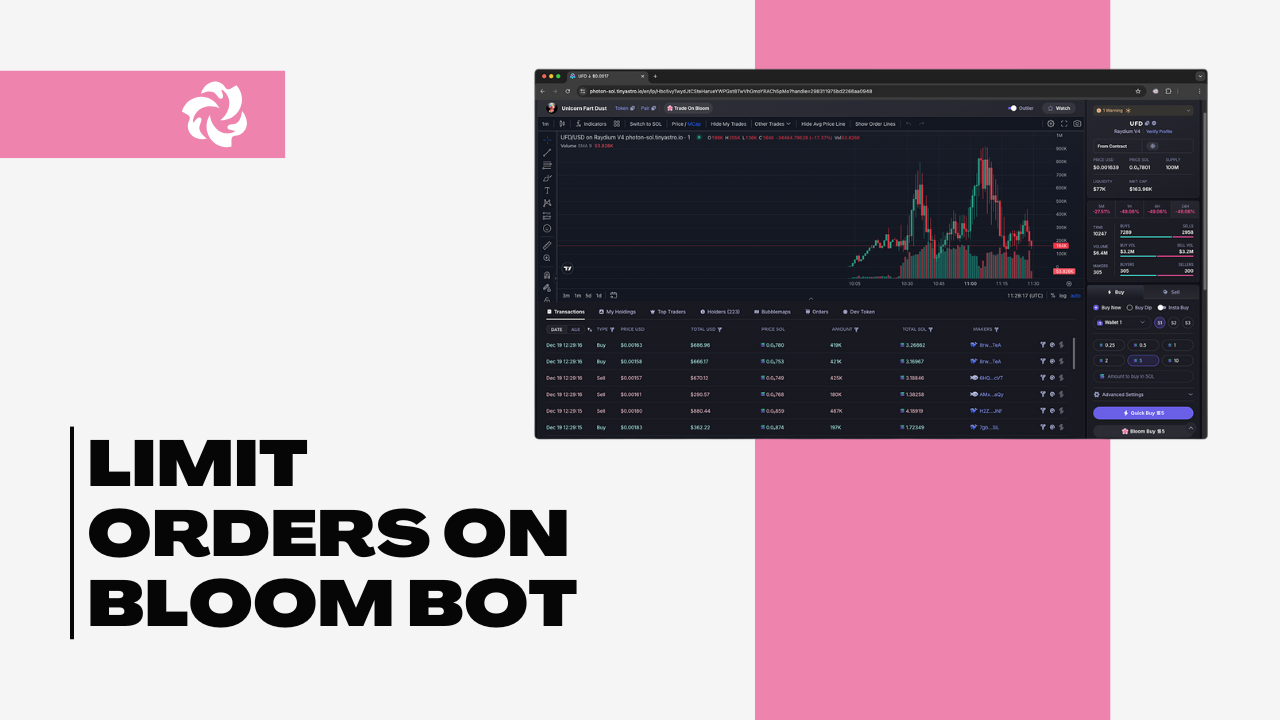

Utilizing Limit Orders for Price Control

Sometimes, you don't want to buy or sell at the current market price. Maybe you've got a specific profit target in mind, or you want to enter a trade only if the price drops to a certain point. That's where limit orders come in handy. With Bloom Bot, you can set these exact conditions. For instance, you could tell the bot to sell a token only when it hits a 20% profit, or to buy a token if its price dips below a certain SOL amount. This helps you stick to your plan and avoid making rushed decisions when the market gets wild. You can set these up right from the positions menu in the bot.

Copy Trading Successful Wallets

Ever look at someone else's wallet and think, "Wow, they really know what they're doing"? Bloom Bot lets you tap into that. You can actually copy the trades of wallets that have a good track record. It's a smart way to learn from experienced traders or just to automate your strategy by following proven methods. You'll need to find a wallet address you want to follow, then link it in the bot. You can even set how much you want to allocate to each trade or if you want to mirror their sell actions too. It’s a great way to gain insights without doing all the heavy lifting yourself. Check out other Solana trading bots to see how they compare.

Navigating Degen Mode for High-Risk Trades

Now, for those who like a bit more excitement and are comfortable with higher risk, there's Degen Mode. This feature is built for those super-fast, speculative trades where timing is everything. When you activate Degen Mode, the bot can automatically buy tokens the moment you input their address. It's designed for speed in volatile markets. You'll want to set your buy amounts, slippage, and maybe even market cap limits here. Just remember, this mode is for high-risk, high-reward situations. It’s probably best to start small and get a feel for it before going all in. This is one of the advanced features that really shows the flexibility of Bloom Bot.

Trading on Solana can be fast-paced, and using tools like Bloom Bot's advanced features can help you stay in the game. Whether it's setting precise limit orders, learning from successful traders through copy trading, or diving into the fast lane with Degen Mode, these options give you more control and potential opportunities. Just remember to manage your risk, especially when exploring features like Degen Mode.

Security and Fee Structure in Solana Trading

When you're trading on Solana, keeping your assets safe and understanding the costs involved is pretty important. Bloom Bot tries to make this straightforward for you. Let's break down how it handles security and what you can expect regarding fees.

Bloom Bot's Anti-MEV Protection

One of the things you'll want to watch out for in crypto trading is MEV, or Maximal Extractable Value. Basically, other bots or traders can see your transaction before it's confirmed and jump ahead of you, which can mess with your prices. Bloom Bot has a feature to help protect against this. By using processors like Jito, it aims to make sure your trades aren't easily front-run. This means when you set up a trade, it's more likely to go through at the price you expect, without someone else cutting in line. It's a good idea to keep this protection turned on, especially when you're dealing with popular tokens or during busy market times.

Protecting your trades from MEV is a key part of secure trading on Solana. Bloom Bot's built-in features help you avoid common pitfalls that can eat into your profits.

Understanding Bloom Bot Transaction Fees

So, how does Bloom Bot make money, and what does it cost you? For every buy and sell transaction you make, there's a small fee. The standard fee is 1% of the transaction value. This fee helps keep the bot running, supports its development, and covers the costs of maintaining the platform. It’s pretty standard for trading bots like this. For example, other bots like Maestro Bot also have fee structures to keep their services going.

Here’s a quick look at the fees:

- Standard Fee: 1% on all buy and sell transactions.

- Purpose: Funds platform development, infrastructure, and team support.

It's worth noting that Solana's network fees themselves are incredibly low, often fractions of a cent, which is a big advantage compared to networks like Ethereum. You can see the general difference in gas fees across blockchains.

Reducing Fees Through Referral Programs

Now, here's a way to save a bit on those fees. Bloom Bot has a referral program. If you sign up using a referral link from an existing user, you can get a discount. This usually knocks 10% off the transaction fee, bringing it down to 0.9%. It’s a nice little perk that can add up if you’re trading frequently. So, if you know someone who uses Bloom Bot, asking for their link is a good move. This also applies if you share your own link with friends, helping them save too. It’s a win-win that encourages community growth, similar to how referral programs work for other tools like Photon Bot.

Comparing Trading Bot Costs and Value

When you're looking at trading bots, it's easy to get caught up in all the fancy features, but you've got to think about the costs too, right? You don't want to spend more on fees than you're making. That's where Bloom Bot really tries to be different.

Bloom Bot's Fee Transparency

Bloom Bot keeps things pretty straightforward with its fees. You'll pay a 1% fee on every buy and sell transaction. This fee helps keep the bot running and allows for new features to be added. It's not some hidden charge; it's right there. If you sign up using a referral link, you can actually get a 10% discount, bringing that fee down to 0.9%. That might not sound like much, but if you're trading a lot, it adds up.

Here’s a quick look at the fees:

- Standard Fee: 1% per transaction

- Discounted Fee: 0.9% with a referral link

The fees collected are used to maintain the platform's servers, develop new tools, and ensure the security of your trades. It's about keeping the service reliable and improving it over time.

Cost-Effectiveness Against Competitors

Compared to some other options out there, Bloom Bot is pretty competitive. For instance, trading on Ethereum can get really expensive, with fees sometimes reaching $50 or more for simple DeFi actions, which is just not practical for active trading. Solana, where Bloom Bot operates, is known for its low costs. While other bots might charge similar percentages, the ability to get that 0.9% rate with a referral makes Bloom Bot a more budget-friendly choice. You can find more about how different bots stack up in the Solana ecosystem.

The Value of Continuous Platform Development

So, why pay those fees at all? Well, the money goes back into making Bloom Bot better. Think about it: new features like advanced sniping tools, better AFK modes, or improved copy-trading capabilities don't just appear out of nowhere. They need development time and resources. By paying the fee, you're essentially investing in a platform that's always trying to give you an edge. It’s a trade-off: a small percentage of your trades for a bot that’s constantly being updated and improved, unlike some platforms that might just offer basic functions. This ongoing development is what helps keep tools like Bloom Bot relevant in the fast-paced crypto world, similar to how other platforms like BullX also focus on continuous improvement.

When picking a trading bot, it's smart to look at how much it costs and what you get for your money. Some bots are cheap but don't do much, while others cost more but can really help you make better trades. Think about what features are most important for your trading style. We've broken down the costs and benefits to help you decide. Want to learn more about finding the right bot for you? Visit our website today!

Wrapping Up: Solana vs. Ethereum for Your Trades

So, you've looked at what Solana and Ethereum bring to the table for trading. Solana offers speed and lower costs, which is pretty sweet for getting in and out of trades quickly. Ethereum, on the other hand, has a huge ecosystem and a lot of history, but you'll likely pay more in fees and wait a bit longer. When you're deciding where to park your trading funds, think about what matters most to you. Do you need things to move fast and cheap, or are you okay with higher costs for the established network? It really just depends on your own trading style and what you're trying to achieve.

Frequently Asked Questions

What exactly is Bloom Bot and how do I use it?

Think of Bloom Bot like a helpful assistant for trading crypto on the Solana network. It’s built using Telegram, so you can use it right from your phone or computer. It helps you do things like buy tokens super fast when they first come out, or even copy trades from people who are already good at it. It’s made to be easy for beginners but also has cool stuff for experienced traders.

How do I set up Bloom Bot and my trading wallet?

Getting started is pretty simple! You just need Telegram. Click a link to find the Bloom Bot, and then press 'Start'. It will guide you through creating your own Solana wallet right there. Just make sure to save your wallet's secret key super safely – it's only shown once!

What are the main things I can do with Bloom Bot?

Bloom Bot has some awesome features. You can 'snipe' new tokens, meaning you buy them the moment they launch to try and catch early price jumps. There's also a 'Quick Buy/Sell' for when you need to trade right away. Plus, 'AFK Mode' lets you set up trades to happen automatically even when you're not watching!

Can I do more advanced trading with Bloom Bot?

Yes, Bloom Bot has ways to trade smarter. You can use 'Limit Orders' to set exact prices for buying or selling, so you don't miss out on good deals. You can also 'Copy Trade' by following wallets of successful traders and letting the bot do what they do. And for the really adventurous, there's 'Degen Mode' for super fast, high-risk trades.

How much does Bloom Bot cost and is it safe?

Bloom Bot charges a small fee, usually 1% for each trade, which helps keep the bot running and getting better. But here's a cool trick: if you sign up using a special referral link, you get a 10% discount, making the fee only 0.9%! This is pretty cheap compared to other trading bots out there. They also have 'Anti-MEV Protection' to help keep your trades safe from sneaky bots.

How much money should I put in to start, and what's the best way to stay safe?

It's a good idea to start with a smaller amount of SOL, especially when you're just learning how the bot works. Once you feel more comfortable and understand how its features help your trades, you can add more funds. Always remember to keep your wallet's secret key super safe, maybe in a password manager or an encrypted file!

More Bloom Bot Guides: