Pro Trading Bot Tips Every Crypto Trader Needs to Know

So, you're looking to step up your crypto game, huh?

Using a trading bot can really change things, and Bloom Bot is a solid choice, especially on the Solana network.

It's got stuff for everyone, from folks just starting out to those who think they're already pros.

We're going to break down some pro trading bot tips for crypto traders, focusing on how to get the most out of tools like Bloom Bot.

Think of this as your cheat sheet to trading smarter, not harder.

Key Takeaways

- Bloom Bot makes crypto trading on Solana simpler, with features like sniping for early token buys and quick buy/sell options for fast trades.

- You can automate your trading using AFK Mode by setting rules for buying and selling, plus use limit orders to control your entry and exit prices.

- Copy trading lets you mirror successful traders' wallets, and features like anti-MEV protection help keep your trades secure.

- Understand Bloom Bot's 1% fee structure and how using a referral link can lower it to 0.9%, with fees supporting platform development.

- Always secure your wallet keys, start with small trades to test strategies, and stay informed about market trends for better results.

Leveraging Bloom Bot for Enhanced Crypto Trading

Getting started with Bloom Bot is pretty straightforward, especially if you're looking to simplify your crypto trading.

This tool is built to work with Telegram, making it accessible right from your phone or computer.

You'll want to understand how Bloom Bot works at its core to make the most of it.

It's designed to help you trade more efficiently, particularly on the Solana network.

You can get started by just opening the bot on Telegram and hitting the 'Start' button.

It's a pretty user-friendly way to manage your crypto trades without needing to be glued to a desktop all day.

Remember to save your private keys securely; losing them means losing access to your funds.

If you're new to this, starting with smaller trades is a good idea to get a feel for how the bot operates before committing larger amounts.

You can find more details on how the bot works on their official website.

Understanding Bloom Bot's Core Functionality

At its heart, Bloom Bot is a trading assistant that automates many of the tasks involved in crypto trading.

It's particularly good for Solana and Ethereum assets.

You can set up custom strategies for buying and selling, and the bot will execute them for you.

This means you don't have to constantly watch the market.

It provides real-time alerts directly through Telegram, so you're always in the loop.

Think of it as having a trading partner that's always on, ready to act on your instructions.

This automation is a big part of why people use tools like BloomBot Crypto.

Navigating the Telegram Interface for Trading

Since Bloom Bot operates through Telegram, you'll be interacting with it via chat commands.

The interface is designed to be simple.

You'll use commands to set up trades, check your portfolio, and manage your settings.

It's pretty intuitive once you get the hang of it.

You can access Bloom Bot from any device where you use Telegram, which is convenient.

Just make sure you're using the correct bot link to avoid any potential scams; it's important to be aware of these risks in the crypto space, and resources exist to help you identify them here.

Setting Up Your Solana Wallet with Bloom Bot

When you first start using Bloom Bot, it will help you create a new Solana wallet.

This wallet is where your funds for trading will be held.

The bot will show you your private key only once, so it's really important to write it down and store it somewhere extremely safe, like a password manager.

If you lose that key, you lose access to your wallet.

After creating your wallet, you'll need to deposit some SOL (Solana's native currency) into it to cover transaction fees and fund your trades.

You just send SOL to the wallet address the bot gives you.

It’s a good idea to start with a small deposit to get comfortable with the process.

Mastering Bloom Bot's Advanced Trading Features

Utilizing Sniping for Early Token Opportunities

Sniping is a way to get in on new tokens right when they launch.

Bloom Bot has a feature that lets you do this.

You give it the token's contract address, tell it how much you want to buy, and set things like slippage.

Then, Bloom Bot tries to buy it as fast as possible when it becomes available.

This can be a good way to catch tokens early, but it's also risky because new tokens can be very unpredictable.

It's smart to start with small amounts when you're trying out sniping.

Executing Quick Buy and Sell for Real-Time Trades

Sometimes, you need to make a trade right now, without a lot of setup.

Bloom Bot's Quick Buy and Sell feature is for those moments.

You just need the token's contract address, the amount you want to trade, and then you confirm.

The bot handles the rest instantly.

This is useful when the market is moving fast and you want to react quickly to price changes.

You can use this for both buying and selling, making it a flexible tool for active traders.

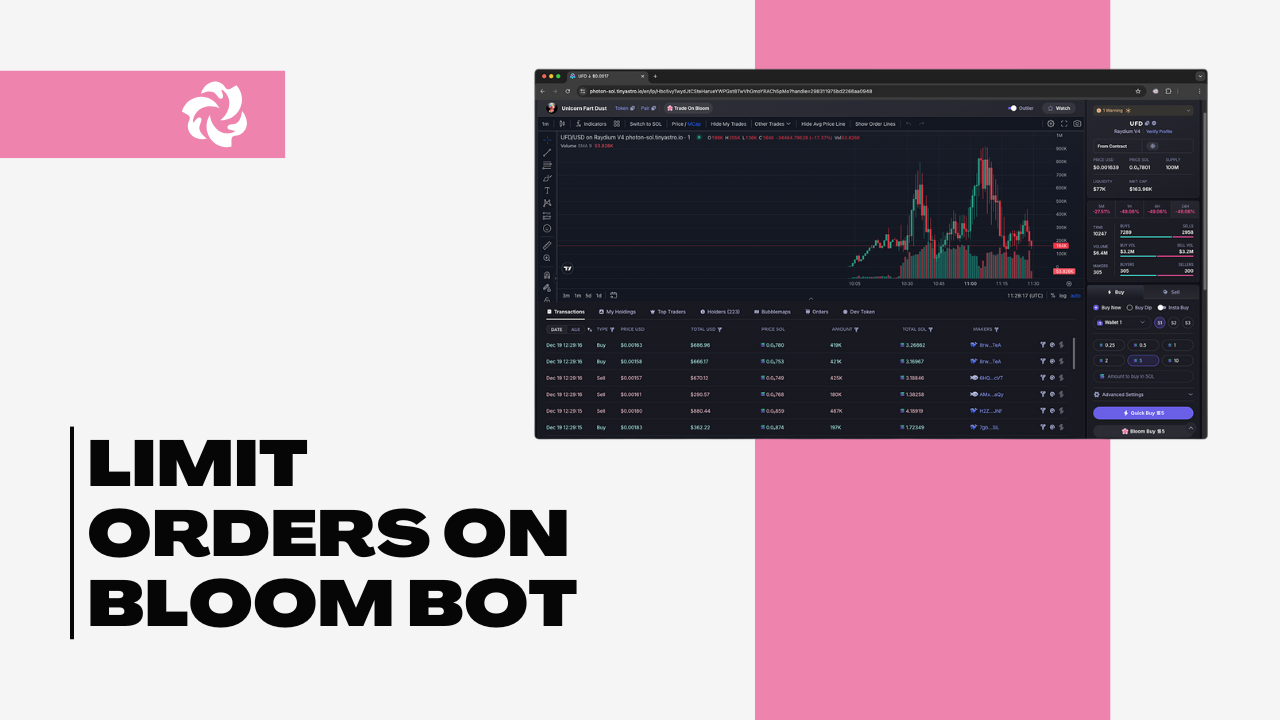

Implementing Limit Orders for Price Control

Limit orders give you more control over the price you buy or sell at.

With Bloom Bot, you can set specific conditions.

For example, you could say, 'Sell this token if its price goes up by 10%' or 'Buy this token if its price drops to X amount'.

This helps you stick to your trading plan and avoid making decisions based on emotions when the market gets wild.

You can set these up in the positions menu.

It’s a solid way to manage your trades without constantly watching the charts.

You can find more about using features like limit orders on the Solana Telegram Bot.

Using these advanced features requires a good understanding of the market and the specific tokens you are trading. It's always a good idea to test these strategies with smaller amounts of capital before committing larger sums. Remember, Bloom Bot is a tool to assist your trading, but your own research and risk management are still key.

Automating Strategies with Bloom Bot's AFK Mode

Sometimes you just can't be glued to your screen, right?

That's where Bloom Bot's AFK (Away From Keyboard) Mode comes in handy.

It lets you set up your trading rules and then just let the bot do its thing.

Think of it as setting your trades on autopilot.

You can configure it to buy or sell tokens based on specific conditions you define, so you don't miss out on opportunities even when you're busy with other stuff.

It’s a pretty neat way to keep your trading active without constant monitoring.

You can really make your crypto work for you with this feature.

Configuring Rules for Automated Buying and Selling

Getting AFK Mode set up is pretty straightforward.

You tell Bloom Bot what you want it to do.

This involves setting up rules for when to buy and when to sell.

You can specify things like the amount of SOL to use for a buy, or a target profit percentage for a sell.

It’s all about creating a plan and letting the bot execute it.

This helps you stick to your strategy, avoiding those impulse decisions that can sometimes mess up a good trade.

You can set up multiple rules, too, giving you a lot of flexibility.

Setting Parameters for Market Cap and Liquidity

To make your automated trades smarter, you can set parameters like market cap and liquidity.

This means you can tell Bloom Bot to only buy tokens that meet certain criteria.

For example, you might only want to trade tokens with a market cap above a certain amount, or those that have a minimum amount of liquidity.

This helps filter out less promising projects and focus on ones that might have more potential.

It’s a good way to add a layer of risk management to your automated strategy.

You can find more about how Bloom Bot works on their official channels.

Utilizing Stop-Loss Levels for Risk Management

One of the most important parts of any trading strategy is managing risk, and AFK Mode helps with this through stop-loss levels.

You can set a maximum amount you’re willing to lose on a trade.

If the token’s price drops to that level, Bloom Bot will automatically sell it, cutting your losses.

This is super important for protecting your capital, especially when you’re not actively watching the market.

It’s a safety net that can save you from significant downturns.

Setting these levels correctly is key to making sure your automated strategy doesn't turn into a runaway train.

AFK Mode is designed to keep your trading active even when you're not. By setting clear rules and parameters, you can automate your buy and sell orders, manage risk with stop-loss levels, and even filter opportunities based on market cap and liquidity. It’s a powerful tool for consistent trading without constant attention.

This feature is a big part of making Bloom Bot a truly useful tool for anyone serious about crypto trading.

It allows you to be strategic and disciplined, even when life gets in the way.

Remember to test your settings with smaller amounts first to get a feel for how it operates before committing larger sums.

You can explore more about automating trades with Bloom Bot to get a better grasp of its capabilities.

Exploring Copy Trading and Safety Protocols

Mirroring Successful Trader Wallets

Copy trading with Bloom Bot lets you follow the moves of traders who are doing well.

It’s a way to learn from others or just let the bot do the work for you.

You just need to find a wallet address of a trader you want to copy.

Then, you tell Bloom Bot to watch that wallet. You can set how much you want to spend on each trade the bot copies, or how much of your total funds to use.

You can also decide if you want the bot to copy their sell actions too.

This is pretty handy if you're new to trading and want to see how profitable strategies play out without having to figure it all out yourself.

It’s a good way to get a feel for the market and see what works.

You can find more info on how copy trading is changing the game here.

Configuring Copy-Trading Parameters

Once you've picked a wallet to copy, you need to tell Bloom Bot how you want it to copy those trades.

This is where you set the rules.

You can decide the maximum amount of SOL you're willing to spend on any single token purchase that the bot copies.

You might also want to set a percentage of your total trading capital that the bot can allocate to these copied trades.

Another setting to consider is whether you want Bloom Bot to automatically sell the tokens when the trader you're copying sells them.

This gives you control over how much risk you're taking and how your capital is used.

It’s all about tailoring the copy trading to your own comfort level and goals.

Implementing Anti-MEV Protection for Secure Trades

When you're trading, especially on busy networks like Solana, there are risks like MEV (Maximal Extractable Value) bots that can try to get ahead of your trades.

Bloom Bot has a feature called Anti-MEV protection to help prevent this.

It works by using special processors to make your transactions harder for these bots to see and interfere with.

This protection is important for making sure your trades go through at the price you expect, without being unfairly impacted.

You can usually find this setting within the bot's security or transaction options.

It’s a good idea to have this turned on, especially when you're dealing with new or fast-moving tokens.

Keeping your trades secure is a big part of successful trading, and Bloom Bot offers tools to help with that. You can learn more about general security measures for AI trading here.

Understanding Bloom Bot's Fee Structure and Discounts

Understanding Bloom Bot's Fee Structure and Discounts

When you're trading crypto, keeping an eye on fees is pretty important, right?

Bloom Bot keeps things pretty straightforward on this front.

You'll find a standard 1% fee applied to every buy and sell transaction you make.

This fee helps keep the platform running, supports ongoing development, and makes sure everything stays secure.

It's a pretty common setup for trading bots, actually.

Standard Transaction Fees on Bloom Bot

So, the basic fee is 1% on all your trades.

This covers the costs of running the bot and improving its features.

It’s a flat rate, so you know what to expect with each trade you execute using the bot.

This fee structure is designed to be competitive within the Solana ecosystem.

Benefits of Using Referral Links for Fee Reduction

Now, here's a nice little perk: you can actually lower that fee.

If you sign up for Bloom Bot using a referral link, your transaction fee drops to 0.9%.

That's a 10% discount, which can add up, especially if you're trading frequently.

It’s a good way to save a bit and also helps grow the Bloom Bot community.

You can find referral links from existing users or through official Bloom Bot channels.

Just make sure you sign up through the link to get that reduced rate automatically applied to your account.

How Bloom Bot Fees Support Platform Development

It's worth knowing where that fee money goes.

The fees collected are reinvested back into Bloom Bot.

This means better infrastructure, more security updates, and the development of new features to make your trading experience smoother.

Think of it as contributing to a tool that’s constantly getting updated and improved.

This approach helps ensure Bloom Bot remains a top choice for Solana trading and keeps pace with the fast-moving crypto market.

The platform aims for transparency, so you know your fees are supporting the service you use.

The fees are essential for maintaining the bot's performance, security, and continuous innovation, ultimately benefiting all users by providing a reliable and evolving trading tool.

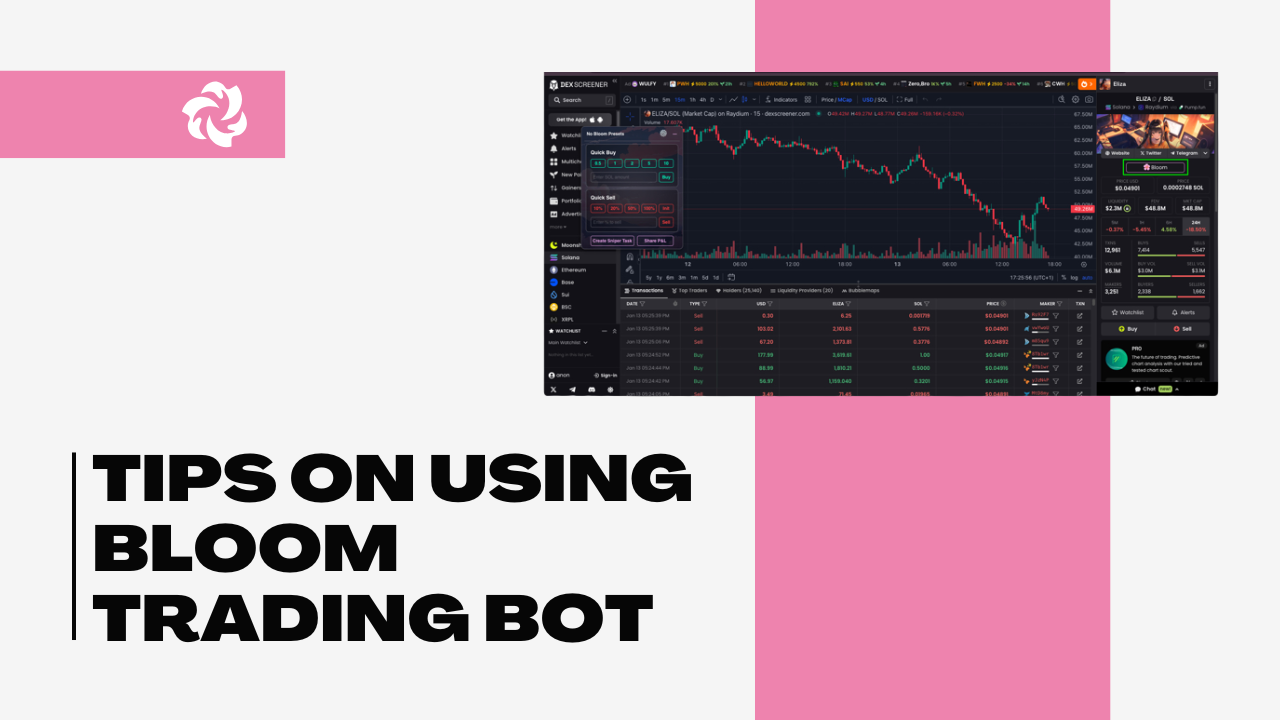

Best Practices for Pro Trading Bot Tips for Crypto Traders

When you're using a tool like Bloom Bot, it's easy to get caught up in the excitement of trading.

But to really make progress and avoid common pitfalls, you need a solid approach.

Think of it like learning any new skill – practice and smart habits make all the difference.

Securing Your Wallet and Private Keys

This is probably the most important thing you can do.

Your wallet is where your crypto lives, and your private key is the only way to access it.

If someone gets your private key, they have access to everything.

Bloom Bot will generate a Solana wallet for you when you start, and it shows you the private key one time.

You absolutely have to save this somewhere safe.

Don't just leave it in your Telegram messages.

Consider using a password manager or an encrypted file.

Losing your private key means losing your funds, period.

It's not something you can recover later, so treat it with extreme care.

Starting with Small Trades to Refine Strategies

Don't go all-in on your first trade.

It's tempting, especially if you see a token that looks like it's about to take off.

But Bloom Bot has a lot of features, and you need time to get comfortable with them.

Start with small amounts of SOL to fund your trades.

This lets you test out different features, like sniping or using AFK mode, without risking a lot of money.

You can learn how the bot executes trades, how slippage affects your transactions, and how to set limit orders effectively.

As you get more confident and your strategies prove successful, you can gradually increase your trade sizes.

It’s a smart way to build your trading skills and understand the market better.

Staying Informed on Market Trends and Token Research

Even with a powerful tool like Bloom Bot, you can't just turn off your brain.

The crypto market moves fast, and new tokens pop up all the time.

While Bloom Bot can help you find opportunities, doing your own research is still key.

Keep an eye on what's happening in the Solana ecosystem and the broader crypto space.

Understand the tokens you're trading – what's their purpose?

Who's behind them?

Are they gaining traction?

Combining Bloom Bot's automation with your own informed decisions will give you the best chance of success.

You can use Bloom Bot to execute trades quickly once you've done your research, but the research itself is up to you.

Remember, bots are tools, not magic money machines.

High-Risk, High-Reward Trading with Degen Mode

Understanding Degen Mode's Functionality

Degen Mode with Bloom Bot is where things get really spicy.

Think of it as the express lane for trading, designed for those moments when you want to jump on a token the second it hits the market.

It’s all about speed and getting in early, which means you're also taking on more risk.

This mode is built for high-risk, high-reward plays.

When you activate Degen Mode, Bloom Bot can automatically buy tokens as soon as you input their contract address.

It’s pretty wild because it cuts down on the setup time, letting you react to fast-moving markets almost instantly.

Just remember, this isn't for the faint of heart; it’s for traders who are comfortable with significant volatility and are looking for those explosive gains.

It’s a tool for speculative trading, so be ready for anything.

Configuring Parameters for Fast-Moving Trades

To really make Degen Mode work for you, you’ve got to dial in the settings.

Bloom Bot lets you set specific parameters to help manage the chaos.

You can adjust things like your buy amount, which is how much SOL you’re willing to spend on a single trade.

Slippage is another big one; you’ll want to set this appropriately to ensure your transaction goes through, even if the price jumps a bit right after you click.

Think about setting a higher slippage tolerance for Degen Mode compared to your regular trades.

You can also set market cap limits, which helps you filter out tokens that are too small or too new to be stable.

It’s about finding that sweet spot where the potential for a quick profit is high, but the risk isn’t completely out of control.

You're essentially telling Bloom Bot, "Get me into this token fast, but don't spend more than X and tolerate Y slippage".

Approaching Degen Mode with Caution and Testing

Look, Degen Mode is exciting, but it’s also where you can lose money quickly if you’re not careful.

The best advice is to start small.

Seriously, don't go all-in on your first Degen Mode trade.

Use Bloom Bot’s features to test the waters.

Maybe start with a small buy amount, or even try it out on a token you’re less concerned about.

It’s a good idea to keep an eye on market trends and do some quick research on the tokens you’re targeting before you dive in.

Remember, this mode is about speed, so sometimes you won’t have time for deep research, but having a general sense of the market helps.

Always have a plan for when to sell, too, whether that’s a profit target or a stop-loss.

You can use Bloom Bot’s limit orders for this, even within Degen Mode, to help protect your capital.

It’s about balancing that thrill of the chase with smart risk management.

Ready to take a chance on big wins?

Our Degen Mode lets you go for those trades that could pay off big, even if they're a bit risky. It's all about smart bets for potentially huge rewards. Want to see how it works? Visit our website to learn more and start trading with confidence!

Conclusion

So, you've learned about what trading bots like Bloom Bot can do.

They can help you trade faster and maybe even catch opportunities you might miss otherwise.

Remember to always keep your private keys safe and start with small amounts to get a feel for things.

Using features like AFK mode or copy trading can be useful, but don't forget to do your own research too.

Trading involves risks, and bots are just tools to help you manage them.

Keep learning and stay safe out there.

Frequently Asked Questions

Is Bloom Bot good for beginners?

No worries if you're new to crypto! Bloom Bot is made to be super easy to use. Features like quick buying and copying other traders make it simple to get started, but it also has cool stuff for experienced traders.

What happens if I lose my private key?

Oh no! If you lose your secret key, you can't get your money back. So, make sure to save it somewhere super safe, like a password app or a secure file, and don't share it with anyone.

How much SOL should I put in first?

When you're just starting out, it's smart to put in a small amount of SOL. Once you feel more comfortable with how the bot works and its features, you can add more money based on how you want to trade.

Can I use Bloom Bot on different devices?

You bet! Since Bloom Bot works with Telegram, you can use it on your phone, computer, or tablet anywhere you have Telegram installed. It's super convenient!

How do I avoid MEV attacks?

To stay safe from sneaky bots trying to trade before you, turn on Bloom Bot's anti-MEV protection. It helps make sure your trades go through smoothly and securely.

Is Degen Mode safe for everyone?

Degen Mode is for traders who like a bit of risk for potentially bigger rewards. If you're new to trading, it's better to try out the other features first. If you want to use Degen Mode, start small and be careful!

More Bloom Bot Guides: