Ethereum Tips and Tricks for Every Crypto Investor

So, you're looking to get into Ethereum? Awesome! It's a big, exciting world out there, and honestly, it can feel a bit much at first. But don't worry, we've got your back. This article is all about giving you some solid ethereum crypto tips and tricks, whether you're just starting out or you've been around the block a few times. We'll cover everything from what Ethereum actually is to how to keep your digital stuff safe and even how to save a few bucks on transaction fees. Let's get started!

Key Takeaways

- Ethereum is a special kind of blockchain that lets people build all sorts of applications, not just send money. It's different from Bitcoin because of this.

- You need to know your way around the Ethereum network. This means understanding the basic parts of it and having the right tools to use it.

- If you want to build your own apps on Ethereum, you'll need to set up your computer for it. Then you can write smart contracts and put your apps on the network.

- Keeping your investments safe on Ethereum is a big deal. There are common problems with smart contracts, so you need to know how to avoid risks and protect your digital money.

- Transaction fees on Ethereum can get high. We'll show you how to understand these fees, make your transactions cheaper, and keep an eye on gas prices.

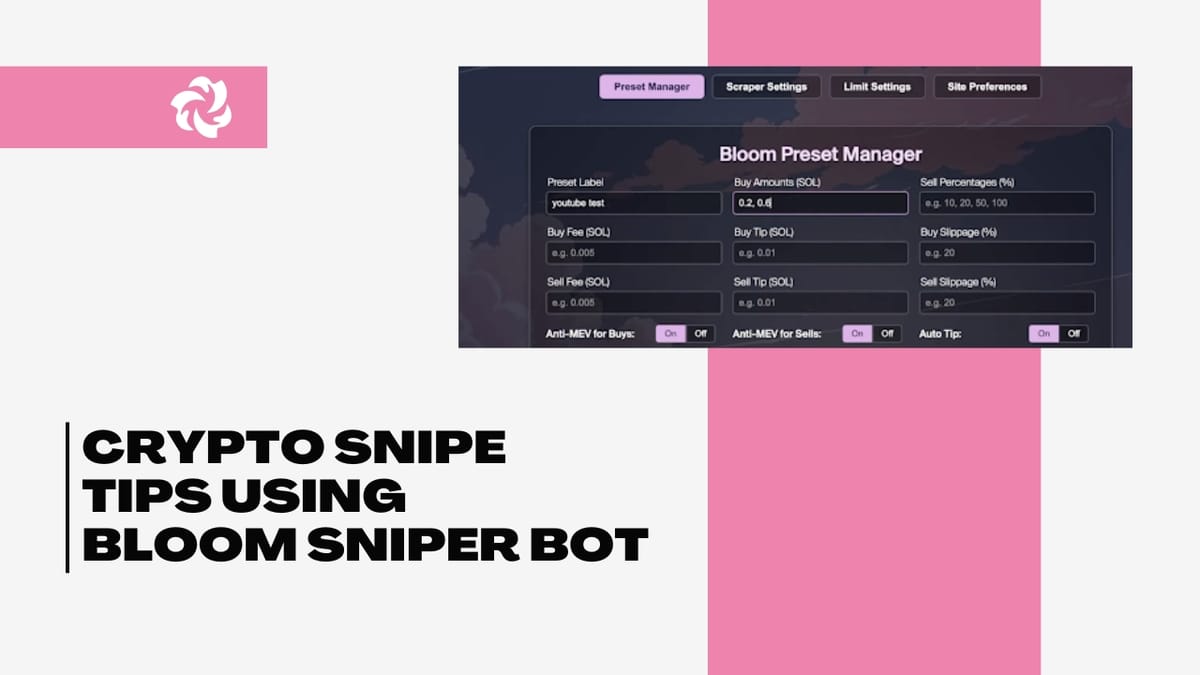

How to Copy Trade with Bloom Bot

Understanding the Ethereum Blockchain

Ethereum's Foundational Principles

Okay, so Ethereum. It's more than just some digital money thing. It's like a whole new way of doing stuff online, without needing a central company controlling everything. Think of it as a shared computer that everyone can use, and no single person can shut it down. The core idea is decentralization, meaning power is spread out instead of concentrated.

- Transparency is key. All transactions are public.

- Immutability is also important. Once something is on the blockchain, it can't be changed.

- It's all about trust, but without needing to trust a specific person or company.

Ethereum's design allows for complex applications to be built directly on the blockchain, opening up possibilities that weren't feasible before.

Distinguishing Ethereum from Bitcoin

People often mix up Ethereum and Bitcoin, but they're pretty different. Bitcoin was mainly designed to be a digital currency, a way to send money online. Ethereum, on the other hand, is more like a platform. It can do everything Bitcoin does, but it also lets you build all sorts of other applications on top of it. Think of Bitcoin as a calculator and Ethereum as a smartphone. You can use the smartphone to do calculations, but you can also do a whole lot more. The Ether token is used to pay for transaction fees.

- Bitcoin focuses on being a store of value and a payment system.

- Ethereum aims to be a platform for decentralized applications (dApps).

- Ethereum uses smart contracts, which Bitcoin doesn't really have.

The Power of Programmable Blockchain

This is where Ethereum gets really interesting. It's a programmable blockchain. That means developers can write code that runs directly on the blockchain. This code is called a "smart contract." Smart contracts can automate all sorts of things, from financial transactions to voting systems. It's like having a self-executing contract that everyone can see and verify. This opens up a ton of possibilities for new kinds of applications that are more secure and transparent than traditional ones.

- Smart contracts automate agreements.

- They eliminate the need for intermediaries.

- They can be used to create decentralized autonomous organizations (DAOs).

Feature | Ethereum | Bitcoin |

|---|---|---|

Primary Purpose | Platform for dApps and smart contracts | Digital currency |

Functionality | Highly programmable | Limited scripting capabilities |

Consensus Method | Proof-of-Stake (after the Merge) | Proof-of-Work |

Navigating the Ethereum Ecosystem

Alright, so you're ready to jump into the Ethereum world? It can seem like a lot at first, but don't worry, it's manageable. Think of it like learning a new city – you start with the basics and gradually explore more.

Key Components of Ethereum

Ethereum isn't just one thing; it's a collection of different parts working together. You've got the blockchain itself, which is like the city's map, recording every transaction. Then there are smart contracts, which are like automated agreements that execute themselves when certain conditions are met. And of course, there's Ether (ETH), the cryptocurrency that powers everything. Understanding these core components is the first step.

Interacting with the Network

To actually use Ethereum, you need a way to connect to the network. This is where wallets come in. A wallet lets you manage your ETH and interact with dApps (decentralized applications). You can pick a wallet, create accounts, manage assets, and acquire ETH. There are different types of wallets – some are software-based, others are hardware-based – so do some research to find one that fits your needs. Once you have a wallet, you can start sending and receiving ETH, using dApps, and exploring everything else Ethereum has to offer.

Essential Tools for Engagement

There are a bunch of tools out there that can make your Ethereum experience easier. Block explorers, like Etherscan, let you view transactions and smart contracts on the blockchain. Gas trackers help you estimate transaction fees. And various dApp browsers let you interact with decentralized applications directly from your wallet. Here's a quick list:

- Block Explorers: Tools like Etherscan to view transactions.

- Gas Trackers: Websites or apps that estimate gas fees.

- DApp Browsers: Wallets or extensions that let you use dApps.

Getting familiar with these tools will make your life a lot easier. They'll help you understand what's going on under the hood and make informed decisions about your transactions.

Developing Decentralized Applications (dApps)

So, you're ready to build something on Ethereum? Awesome! It might seem intimidating at first, but breaking it down into smaller steps makes it manageable. Think of dApps as regular apps, but with their backend running on a decentralized network. This means more transparency and security, but also some new challenges.

Setting Up Your Development Environment

First things first, you'll need to get your workspace ready. This usually involves installing a few key tools. Node.js is a must for running JavaScript-based tools. Then, you'll want to pick a development framework. Truffle is a popular choice because it provides a structured environment for building, testing, and deploying smart contracts. Hardhat is another solid option, known for its speed and flexibility. You'll also need Ganache, which creates a local Ethereum blockchain for testing your dApp without spending real Ether. Once you have these installed, you're ready to start coding. Here's a quick rundown:

- Install Node.js

- Install Truffle or Hardhat

- Install Ganache

Building Smart Contracts

Smart contracts are the heart of any dApp. They're essentially self-executing agreements written in code. Solidity is the most common language for writing smart contracts on Ethereum. It's similar to JavaScript, so if you have some experience with web development, you'll pick it up quickly. Start by defining the structure of your contract: what data it will store and what functions it will perform. Think about the logic carefully, because once a contract is deployed, it's very difficult to change. Testing is crucial at this stage. Use Ganache to deploy your contract to a local blockchain and thoroughly test all its functions. Consider using OpenZeppelin's contracts for common functionalities like token management or access control – they're well-audited and can save you a lot of time and potential headaches.

Deploying dApps on Ethereum

Once your smart contract is tested and ready, it's time to deploy it to the Ethereum network. This involves connecting to a real Ethereum node, which can be done through services like Infura or Alchemy. You'll need some Ether to pay for the gas costs of deployment. Deploying to a test network like Ropsten or Goerli first is a good idea to catch any last-minute issues without risking real funds. After deploying your contract, you'll need to build a user interface for people to interact with it. This usually involves using JavaScript libraries like Web3.js or Ethers.js to connect to the blockchain and call the functions in your smart contract. Remember to handle errors gracefully and provide clear feedback to the user. Security should always be a top priority.

Building dApps can be challenging, but it's also incredibly rewarding. You're creating applications that are transparent, secure, and resistant to censorship. With the right tools and a bit of patience, you can bring your ideas to life on the Ethereum blockchain.

Prioritizing Security in Ethereum Investments

It's easy to get caught up in the excitement of Ethereum and its potential, but security must be your top priority. The decentralized nature of the blockchain means that if something goes wrong, there's often no central authority to help you recover your funds. Let's look at some key areas to focus on.

Common Smart Contract Vulnerabilities

Smart contracts, while powerful, are susceptible to bugs and exploits. Some common vulnerabilities include:

- Reentrancy Attacks: Where a contract recursively calls itself before updating its state, potentially leading to fund drainage.

- Overflow/Underflow: When calculations exceed the maximum or minimum value a variable can hold, causing unexpected behavior.

- Timestamp Dependence: Relying on block timestamps for critical logic, which can be manipulated by miners.

- Denial of Service (DoS): Attacks that make a smart contract unusable by legitimate users.

Understanding these vulnerabilities is the first step in protecting your investments. Always research the smart contracts you interact with and be wary of unaudited or poorly written code.

Strategies for Risk Mitigation

So, how can you protect yourself? Here are a few strategies:

- Do Your Research: Before investing in any project, thoroughly research the team, the code, and the security audits. Look for projects with a strong track record and a commitment to security.

- Use Hardware Wallets: Store your ETH and other tokens on a hardware wallet, which keeps your private keys offline and safe from online attacks.

- Diversify Your Holdings: Don't put all your eggs in one basket. Spread your investments across multiple projects to reduce your risk.

- Be Wary of Phishing Scams: Always double-check the URLs of websites and never enter your private keys or seed phrases on suspicious sites. Phishing scams are rampant in the crypto world.

Protecting Your Digital Assets

Protecting your digital assets goes beyond just securing your private keys. It also involves being smart about how you interact with the Ethereum ecosystem. Here's what I mean:

- Use a Strong Password: Choose a strong, unique password for your Ethereum wallet and any other accounts related to your crypto investments.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your accounts by enabling 2FA. This requires you to enter a code from your phone in addition to your password.

- Keep Your Software Up to Date: Make sure your Ethereum wallet and other software are always up to date with the latest security patches. Outdated software can be vulnerable to attacks.

- Be Careful What You Click: Avoid clicking on suspicious links or downloading files from untrusted sources. These could contain malware that could compromise your computer and steal your crypto assets. For institutional Ethereum staking, high-performance validators are a must.

By taking these precautions, you can significantly reduce your risk of losing your digital assets and enjoy the benefits of the Ethereum ecosystem with greater peace of mind.

Optimizing Gas Fees and Transaction Speeds

Ethereum's gas fees can be a real headache, and slow transaction times? Even worse. But don't worry, there are ways to make things smoother and cheaper. It's all about understanding how the system works and using the right tools.

Understanding Ethereum Gas

Gas is the unit that measures the amount of computational effort required to execute operations on the Ethereum network. Every transaction, from sending ETH to interacting with a smart contract, consumes gas. The higher the complexity of the transaction, the more gas it requires. Think of it like fuel for your Ethereum operations; without enough gas, your transaction won't go through. Ethereum operations all require gas.

Tips for Efficient Transactions

Here are some things you can do to keep your gas costs down and your transactions moving:

- Wait for Off-Peak Hours: Network congestion significantly impacts gas prices. Try to transact when fewer people are using the network, typically during nights or weekends (UTC time).

- Use Simpler Transactions: Complex smart contract interactions cost more gas. If possible, break down large transactions into smaller, simpler ones.

- Adjust Gas Limits Carefully: Setting too low a gas limit will cause your transaction to fail, and you'll still lose the gas. Setting it too high means you're paying for unused gas. Find the sweet spot.

Understanding gas limits and gas prices is key to optimizing your transactions. It's a balancing act between speed and cost, and it takes some practice to get right.

Tools for Gas Price Monitoring

Several tools can help you monitor gas prices in real-time and estimate the optimal gas fee for your transaction. These tools provide insights into current network conditions and suggest appropriate gas prices to ensure timely transaction confirmation. Here are a few examples:

- GasNow: Offers real-time gas price suggestions based on network congestion.

- ETH Gas Station: Provides historical gas price data and estimates for different transaction speeds.

- Block Explorers (e.g., Etherscan): Show current gas prices and recent transaction data.

Using these tools can help you make informed decisions about when and how to submit your transactions, ultimately saving you money and time.

Exploring Decentralized Finance (DeFi) on Ethereum

DeFi is really changing how we think about money and finance. It's all happening on blockchains like Ethereum, and it's pretty wild to see how fast things are moving. It's not just about crypto anymore; it's about building a whole new financial system.

Introduction to DeFi Protocols

DeFi protocols are basically the apps that make DeFi work. Think of them as the building blocks for everything else. You've got lending platforms, decentralized exchanges, and all sorts of other cool stuff. These protocols use smart contracts to automate financial services, cutting out the need for traditional intermediaries like banks. It's like a whole new world of finance, built on code. The Ethereum blockchain is the base for most of these protocols.

Yield Farming and Staking Opportunities

Yield farming and staking are two ways people can earn rewards in the DeFi space. Yield farming involves lending or borrowing crypto assets to earn interest or fees. Staking, on the other hand, involves holding crypto to support the operations of a blockchain network. Both can be pretty lucrative, but they also come with risks. It's like planting seeds and watching them grow, but sometimes the weather can be unpredictable. Here are some things to keep in mind:

- Research different platforms to find the best rates.

- Understand the risks involved, like impermanent loss.

- Start small and gradually increase your investment as you become more comfortable.

Risks and Rewards in DeFi

DeFi isn't all sunshine and rainbows; there are definitely risks involved. Smart contract bugs, rug pulls, and volatility are just a few of the things you need to watch out for. But the rewards can be pretty significant too. Higher interest rates, access to new financial products, and greater control over your assets are all potential benefits. It's a bit like walking a tightrope – exciting, but you need to be careful. Always do your own research before jumping into any DeFi project.

DeFi is still a relatively new space, and things can change quickly. It's important to stay informed and be prepared to adapt to new developments. Don't put all your eggs in one basket, and always be aware of the potential risks involved.

Leveraging Non-Fungible Tokens (NFTs) on Ethereum

NFTs have exploded in popularity, and Ethereum is the place where most of the action happens. It's not just about digital art anymore; NFTs are changing how we think about ownership and value online. From collectibles to in-game items, the possibilities seem endless. But how do you actually get involved?

The Rise of Digital Collectibles

Digital collectibles have been around for a while, but NFTs brought something new: verifiable scarcity. This means you can prove that a digital item is unique and that you own it. Think of it like owning a rare trading card, but instead of keeping it in a binder, it lives on the blockchain. This has opened up a whole new world for artists, creators, and collectors.

Minting and Trading NFTs

Creating (or "minting") your own NFT might sound complicated, but it's becoming easier all the time. You'll need a crypto wallet, some ETH to pay for gas fees, and a platform to mint your NFT. Trading NFTs is also pretty straightforward. Marketplaces make it easy to buy, sell, and auction off your digital assets.

Here's a quick rundown of the minting process:

- Create your digital asset (image, video, audio, etc.).

- Choose an NFT marketplace or platform.

- Connect your crypto wallet.

- Upload your file and set the details (price, description, royalties).

- Mint your NFT!

Understanding NFT Marketplaces

NFT marketplaces are where the magic happens. They're like online art galleries or auction houses, but for digital assets. Some popular marketplaces include OpenSea, Rarible, and Foundation. Each marketplace has its own fees, rules, and communities, so it's worth doing your research before diving in.

It's important to remember that the NFT space is still relatively new and can be volatile. Prices can fluctuate wildly, and there are risks involved. Always do your own research and only invest what you can afford to lose.

Future Trends and Ethereum Upgrades

Ethereum is constantly changing, and keeping up with the latest developments is important for any investor. The network is always evolving, and understanding these changes can help you make better decisions.

The Evolution of Ethereum 2.0

Ethereum 2.0, now simply referred to as Ethereum after the merge, was a major upgrade. It transitioned the network from a Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS). This shift was designed to address scalability and energy consumption issues. The move to PoS was a big deal, and it's still having ripple effects across the Ethereum ecosystem.

Impact of Proof-of-Stake

Proof-of-Stake has changed a lot. Here are some key impacts:

- Reduced energy consumption: PoS uses way less energy than PoW.

- Increased scalability: PoS is supposed to help Ethereum handle more transactions.

- New staking opportunities: Users can now stake their ETH to help secure the network and earn rewards.

The move to Proof-of-Stake was a huge step for Ethereum, but it's not the end of the story. There are still challenges to address, like improving scalability and making the network more accessible to everyone.

Anticipating Future Innovations

So, what's next for Ethereum? There are a few things to keep an eye on:

- Sharding: This is a way to split the Ethereum blockchain into smaller pieces, which could significantly increase transaction speeds.

- Layer-2 scaling solutions: These are technologies that build on top of Ethereum to handle transactions off-chain, making them faster and cheaper.

- Continued development of the Ethereum Virtual Machine (EVM): The EVM is the engine that powers Ethereum smart contracts, and ongoing improvements could make it more efficient and versatile.

It's an exciting time to be involved with Ethereum. The network is constantly evolving, and there are always new opportunities to explore.

Ethereum Season Has Started

Conclusion:

So, that's the rundown. Getting good at Ethereum, or really, any crypto, takes some effort. It's not just about buying some coins and hoping for the best. You gotta know what you're doing. This article gave you some solid ideas to get started. Remember, the crypto world changes fast, so keep learning. Stay safe out there, and good luck with your investments!

Frequently Asked Questions

What exactly is Ethereum?

Ethereum is like a big, worldwide computer that anyone can use. It's not just for sending money, but also for running special programs called 'smart contracts' and building new kinds of apps. Think of it as a super-smart internet where things can happen automatically and safely.

Why do I have to pay 'gas fees' on Ethereum?

Gas fees are like the small payments you make to use the Ethereum network. They pay for the computer power needed to process your actions, like sending money or using an app. These fees can change depending on how busy the network is.

What are dApps, and how are they different from regular apps?

Decentralized apps, or dApps, are like regular apps but they run on the Ethereum network instead of a single company's servers. This means they are more open, can't be shut down easily, and often give users more control over their data.

What is DeFi, and how does it work on Ethereum?

DeFi stands for Decentralized Finance. It's a new way to do financial things like lending, borrowing, and trading without needing traditional banks. It all happens on the Ethereum blockchain, making it more open and available to everyone.

What are NFTs, and why are they so popular?

NFTs are like unique digital items that you can own on the Ethereum network. They can be art, music, or even special game items. Because they're unique and recorded on the blockchain, you can prove you're the real owner.

What's next for Ethereum, and how will it change?

Ethereum is always getting better! The biggest change is 'Ethereum 2.0' (now called the 'Merge' and 'Shapella' upgrades), which made it more energy-efficient and faster. These updates help the network handle more users and new kinds of apps in the future.

Want to learn more about Bloom Bot? Check out these related guides: