Building an Automated Solana Trading Portfolio

Thinking about getting into Solana trading? It can seem a bit much at first, with all the terms and different tools out there. But honestly, it doesn't have to be complicated. We're going to look at how you can build a solid trading setup, focusing on the Solana network. You'll learn about getting started, what features to look out for, and even some ways to trade smarter. Let's get this sorted so you can start trading.

Key Takeaways

- Start your Solana trading journey by easily accessing Bloom Bot through Telegram, setting up your Solana wallet, and depositing SOL.

- Explore core features like sniping early token opportunities, executing quick buy/sell orders, and automating trades with AFK mode for efficient Solana trading.

- Consider advanced strategies such as using limit orders for precision, mirroring successful traders with copy-trading, and trying out high-risk Degen Mode for potential gains.

- Understand Bloom Bot's fee structure, including standard transaction fees and how referral discounts can lower your costs, contributing to platform growth.

- Prioritize security in your Solana trading by using features like Anti-MEV protection, managing slippage settings, and following best practices for safe trading.

Getting Started with Solana Trading

Getting started with trading on Solana is pretty straightforward, especially with tools like Bloom Bot. You don't need to be a crypto wizard to jump in. The whole process is designed to be user-friendly, letting you focus on making trades rather than wrestling with complicated setups.

Accessing Bloom Bot via Telegram

First things first, you'll need Telegram. It's how you'll talk to Bloom Bot. Just find the bot through the link provided and hit 'Start'. It's like opening a chat window, but instead of talking to a friend, you're setting up your trading account. Since Telegram works on pretty much any device, you can manage your trades from your phone or computer, wherever you are. This makes it super convenient to stay on top of the market.

Creating Your Solana Wallet

When you start up Bloom Bot, it actually sets up a Solana wallet for you automatically. Pretty neat, right? This wallet is where all your SOL and any tokens you trade will be kept. The most important thing here is to securely save the private key the bot gives you. It only shows this once, and if you lose it, you lose access to your funds. Seriously, write it down, put it in a password manager, whatever you do, keep it safe and don't share it. Losing that key means losing your crypto.

Depositing SOL for Trading

Once your wallet is ready, you need some SOL to actually trade. SOL is the native currency of the Solana blockchain and is used for transaction fees and to buy other tokens. To deposit, you just send SOL from another wallet or an exchange to the Solana address Bloom Bot gave you. Always double-check the address before sending, because once it's sent, it's pretty much gone if it's wrong. After your SOL arrives, you're all set to start exploring the trading features Bloom Bot has to offer, like checking out new tokens on Solana memecoins.

Here’s a quick rundown of what you need:

- Telegram app installed

- A Solana wallet created by Bloom Bot

- SOL deposited into your Bloom Bot wallet

Once you have these, you're ready to start trading. It’s really that simple to get going with Bloom Bot.

Core Features for Solana Trading

Let's talk about what Bloom Bot can actually do for you when you're trading on Solana. It's not just about having a bot; it's about having tools that help you make smarter moves. You've got a few key features here that really make a difference.

Sniping Early Token Opportunities

This is a big one. You know how some new tokens pop off right after they launch? Bloom Bot lets you get in on those early. You can set it up to automatically buy a token the moment it becomes available. You just need to give it the token's contract address and tell it how much SOL to use. It's like having a front-row seat to the launch. This can be a great way to catch those initial price pumps before everyone else does. It's all about speed and getting your transaction processed quickly, which is where Bloom Bot shines.

Executing Quick Buy and Sell Orders

Sometimes, you don't need to set up a whole sniping task. You just see a price move and want to react now. Bloom Bot's Quick Buy and Sell feature is perfect for that. You can quickly enter a token's address, decide how much you want to buy or sell, and hit go. The bot handles it instantly. This is super useful for day trading or when you just need to get in or out of a position without any fuss. It’s a straightforward way to manage your trades on the fly.

Automating Trades with AFK Mode

What if you can't watch the market all day? That's where AFK (Away From Keyboard) Mode comes in. You can set up specific rules for Bloom Bot to follow. For instance, you can tell it to buy a token if its market cap is below a certain amount, or to sell if the price hits a specific profit target or a stop-loss level. This lets you set a strategy and let the bot execute it automatically, even when you're busy with other things. It’s a way to keep your trading active without needing to be glued to your screen. You can find more details on how these bots work in the Solana ecosystem.

Setting up these features takes a little bit of practice, but once you get the hang of it, you can really start to automate your trading approach. It's about using the bot to your advantage, not the other way around.

Advanced Solana Trading Strategies

Once you've got the basics down, it's time to explore some of the more sophisticated ways you can use Bloom Bot to your advantage. These strategies can help you fine-tune your trades and potentially boost your returns.

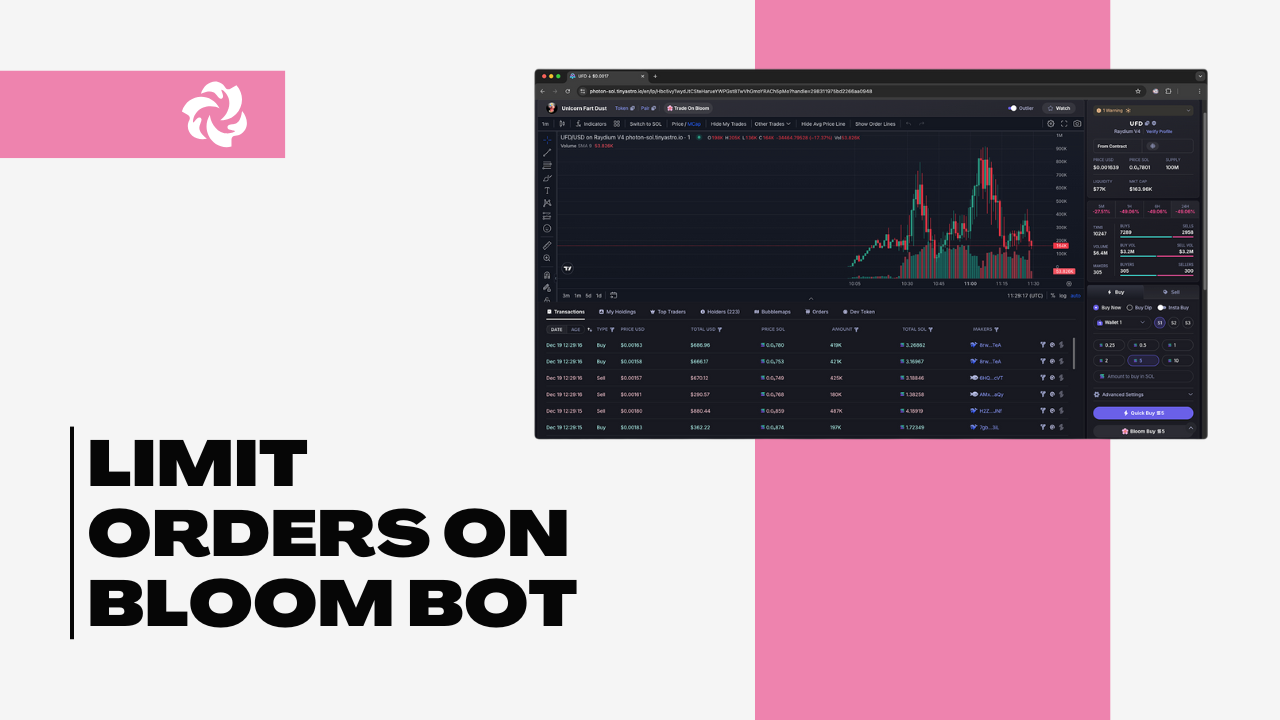

Utilizing Limit Orders for Precision

Sometimes, the market moves too fast to catch the exact price you want. That's where limit orders come in handy. Instead of just buying or selling at whatever the current market price is, you can tell Bloom Bot to only execute a trade when a specific price is met. This is super useful for getting into a token at a lower entry point or selling at a higher exit point, avoiding the guesswork.

For example, you could set a buy limit order for a token if its price drops to a certain level, or a sell limit order to take profit when it hits a target. It’s a great way to stick to your plan without having to watch the charts constantly. You can set these up directly through the bot's interface, making it pretty straightforward.

Mirroring Trades with Copy-Trading

Not sure which tokens to pick or when to buy/sell? Bloom Bot's copy-trading feature lets you follow the trades of other users who are having success. You just need to find a wallet address of a trader you trust or whose performance you admire, and then tell Bloom Bot to mirror their actions. This can be a fantastic way to learn from experienced traders and potentially profit from their strategies.

It's important to do your homework on who you're copying, though. Not all successful traders have strategies that work long-term or in every market condition. You can usually set limits on how much you want to invest per trade or overall, so you don't overextend yourself. It’s a good way to get exposure to different trading styles and see what works.

Engaging in High-Risk Degen Mode

For those who like to live a little dangerously, there's Degen Mode. This feature is built for speed and high-risk, high-reward plays, often involving newly launched tokens or very volatile assets. When you activate Degen Mode, Bloom Bot can execute trades almost instantly with minimal setup required from your end. It’s designed to get you in and out of trades extremely quickly.

Think of it as a shortcut for making rapid, speculative trades. However, because it’s high-risk, you need to be extra careful. Always start with small amounts you can afford to lose, and make sure you understand the risks involved. It’s not for the faint of heart, but for some traders, it can lead to significant gains if timed right. Remember to check out Solana trading bots for more tools that can help you manage these kinds of trades.

Using these advanced features requires a good understanding of the market and the specific tokens you're trading. Always manage your risk and never invest more than you can afford to lose. Bloom Bot provides the tools, but your strategy is key.

Understanding Bloom Bot Fees

When you're trading on Solana, keeping an eye on fees is pretty important. Bloom Bot keeps things straightforward with its fee structure, so you know exactly what to expect.

Standard Transaction Fees

For every buy and sell transaction you make using Bloom Bot, there's a standard fee of 1%. This fee helps keep the bot running smoothly and supports the ongoing development of new features. It's a pretty standard practice in the trading bot world, really.

Reducing Fees with Referral Discounts

Here's a nice perk: you can actually lower that 1% fee. If you sign up for Bloom Bot using a referral link, your transaction fee drops to 0.9%. That's a 10% discount, which can add up, especially if you're trading frequently. It's a good way to save a bit while you're actively trading. You can find referral links from existing users or through official Bloom Bot channels.

Fee Allocation for Platform Growth

So, where does that fee money go? Well, Bloom Bot uses these fees for a few key things:

- Development: To keep adding new tools and improving the bot's performance.

- Infrastructure: To maintain the servers and systems that keep everything running.

- Security: To implement and update security measures, like anti-MEV protection.

- Team: To support the people working behind the scenes to make Bloom Bot better.

The idea is that these fees directly contribute to a better trading experience for everyone using the platform. It's all about making sure Bloom Bot stays competitive and useful in the fast-paced Solana market.

It's good to know that the fees aren't just disappearing into a void; they're reinvested into the platform itself. This transparent approach means you're contributing to a tool that's constantly being improved. For anyone looking to trade on Solana, understanding these costs is part of making smart decisions, and Bloom Bot makes that pretty easy to do.

Enhancing Solana Trading Security

When you're trading on Solana, keeping your assets safe is a big deal. Bloom Bot has built-in features to help you do just that. It's not just about making trades; it's about making them securely.

Implementing Anti-MEV Protection

Front-running, or MEV (Maximal Extractable Value) attacks, can really mess with your trades. Bots can see your transaction before it hits the blockchain and jump in front of it, changing the price you get. Bloom Bot helps you avoid this. By using special transaction processors, it makes your trades harder for other bots to see and exploit. This means you're more likely to get the price you expect when you buy or sell.

Managing Slippage Settings

Slippage is the difference between the price you expect for a trade and the price it actually executes at. In fast markets, this can change quickly. Bloom Bot lets you set your slippage tolerance. If the market moves too much beyond your set limit, the trade won't go through, protecting you from bad prices. It's a good idea to adjust this based on the token's volatility. For very new or fast-moving tokens, you might need a bit more slippage room, but always be mindful of how much you're willing to accept.

Best Practices for Secure Trading

Keeping your crypto safe involves a few key habits. First, always back up your wallet's private key. Bloom Bot generates a wallet for you, and that key is shown only once. Store it somewhere super secure, like a password manager, and never share it. Also, be careful about which links you click, even if they look like they're from Bloom Bot. Stick to official channels for starting the bot. Finally, start with smaller amounts when you're learning new features, like Degen Mode, to get a feel for how they work without risking too much. Remember, secure trading is an ongoing practice, not a one-time setup. You can find more details on securing your Solana wallet through various methods.

Protecting your digital assets is as important as making profitable trades. Bloom Bot provides tools, but your own diligence is key to a secure trading experience.

Comparing Solana Trading Bot Options

When you're looking at different ways to trade on Solana, you'll find a bunch of bots out there. It can get a bit confusing trying to figure out which one is the best fit for you. Let's break down how Bloom Bot stacks up against others, focusing on what really matters for your trading.

Bloom Bot's Competitive Fee Structure

Fees are a big deal, right? Nobody wants to hand over more than they have to. Bloom Bot keeps things pretty simple here. You've got a standard 1% fee on trades. But here's the kicker: if you sign up using a referral link, that fee drops to 0.9%. That's a 10% discount, which adds up, especially if you're trading a lot. It makes Bloom Bot one of the more affordable options out there. Some other bots might have higher base fees, or maybe they don't offer any easy ways to get a discount. It's worth checking out the fee breakdown for any bot you're considering, because those percentages can really eat into your profits over time. You can find more details on how to get that discount on Bloom Bot's fee page.

Transparency in Trading Costs

Beyond just the percentage, how clear is the bot about its costs? Bloom Bot is pretty upfront. The 1% (or 0.9% with a referral) is what you pay for buys and sells. There aren't a bunch of hidden charges popping up later. This transparency is important. You want to know exactly what you're paying for, so you can accurately calculate your potential profits. Some platforms might have separate fees for certain features or higher network fees that aren't immediately obvious. Bloom Bot's approach means you know where your money is going – it helps keep the platform running, gets developed further, and keeps things secure. It's a pretty straightforward deal.

Value Proposition of Bloom Bot

So, what do you actually get for your money with Bloom Bot compared to the rest? Well, it’s not just about the fees, though they are good. You get a bot that’s designed to be easy to use, even if you're new to Solana trading. Features like quick buy/sell, AFK mode for automated trades, and even copy-trading mean you can automate a lot of your work. Plus, they've built in safety features like anti-MEV protection. When you look at other options, like Padre.gg or Nova Click, they all have their own strengths. But Bloom Bot really focuses on making advanced trading accessible without breaking the bank. It's about giving you the tools to trade smarter, whether you're sniping new tokens or just trying to manage your portfolio efficiently. The continuous development funded by fees means the bot should keep getting better, too, which is a nice bonus.

Here's a quick look at how Bloom Bot compares on key features:

| Feature | Bloom Bot |

|---|---|

| Standard Fee | 1% (0.9% with referral) |

| Ease of Use | High (Telegram-based) |

| Key Features | Sniping, AFK Mode, Copy-Trading, MEV Prot. |

| Transparency | High |

| Referral Discount | Yes (10%) |

Ultimately, choosing a trading bot comes down to your personal trading style and what features you prioritize. Bloom Bot offers a solid combination of affordability, ease of use, and useful tools for the Solana ecosystem. It's definitely one of the top contenders if you're looking for a reliable trading assistant. You can explore other Solana sniper bots to see how they compare, but Bloom Bot provides a strong all-around package.

Looking for the best way to trade on Solana? We've checked out different trading bots to help you pick the right one. Some are super fast, others are easier to use. Find out which bot fits your trading style best. Want to see which bot is the top pick? Visit our website to learn more and get started today!

Conclusion

So, you've learned how to set up and use Bloom Bot for your Solana trading. You know how to get started, manage your wallet, and deposit funds. We've covered the main features like sniping for early tokens, quick buys and sells, and even the AFK mode for when you're not actively watching the market. Remember to use the copy-trading feature if you want to learn from others, and always keep those safety features like MEV protection turned on. Don't forget about the fees; using a referral link can save you a bit of money on each trade. Keep practicing, start small, and explore all the tools Bloom Bot offers to build your automated trading portfolio.

Frequently Asked Questions

How do I get started with Bloom Bot?

You can start using Bloom Bot by just having Telegram! Find the bot link, tap 'Start', and it'll walk you through everything you need to set up your trading account. You can use it on your phone or computer, anytime, anywhere.

How do I create a wallet with Bloom Bot?

When you first start Bloom Bot, it automatically makes a new Solana wallet for you. This is where all your trading money will be kept. It's super important to save the secret key it shows you – it only appears once! Keep it super safe, like in a password manager, and don't leave it in your Telegram chat.

How do I add SOL to my trading wallet?

To trade, you'll need to put SOL (that's the main money for the Solana network) into your new wallet. Just send the SOL you want to trade to the wallet address Bloom Bot gives you. Make sure to check the address carefully before sending!

What is 'sniping' and how does it work on Bloom Bot?

Bloom Bot lets you grab new tokens right when they launch, which is called 'sniping'. You just tell the bot the token's address and how much you want to buy, and it tries to get it for you super fast. It's a great way to get in early on promising coins.

Can I automate my trades with Bloom Bot?

You can set up trades to happen automatically even when you're not watching, using the 'AFK Mode'. You tell the bot the rules, like how much to buy or when to sell if the price drops. This way, your trades can keep going without you needing to be there all the time.

Can I copy other people's trades with Bloom Bot?

Yes! Bloom Bot has a feature called 'Copy-Trading' where you can follow other successful traders. You just give the bot the address of a wallet you like, and it can copy their trades. It's a cool way to learn from others and potentially make trades that work well.

More Bloom Bot Guides: